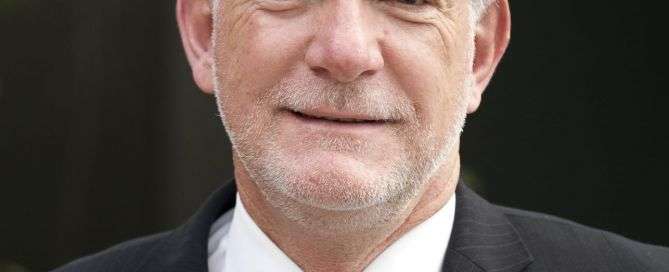

Economic Outlook for 2023 with Darryl Gobbett

In 2022, farmers experienced significant increases in interest rates, important input costs, particularly fertiliser, chemical and fuel, and changes to their commodity prices. While changes to these important components of the farming business are common, we haven’t experienced these large increases for some time. It’s important to be informed on what changes might be expected in 2023 so that we can be proactive in our planning for the coming season. Darryl Gobbet is an experienced economist with the rare ability to communicate clearly on these complex issues. He will provide you a background to what [...]