I just wanted to share some observations on rural banking since the Banking Royal Commission has been completed. These observations come from both farmers and advisers that have been using the farm business software P2PAgri to help sharpen their farm business performance and improve the information they provide to their bank.

Can you really negotiate low interest rates in rural banking?

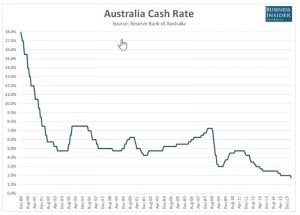

Interest rates are now at an historic low level with the Reserve Bank of Australia (RBA) decreasing interest rates twice in the last few months. See this in the Graph 1 below. This combined recent interest rate drop of 0.5% may not have been fully passed on to your bank’s lending interest rate, as not all the bank’s ‘cost of funds’ (the interest on money they buy) are affected by the RBA’s set interest rates. However, you should have noticed some drop in your interest being paid. If you don’t know, ring your bank and find out if it has dropped, and if not, ask them why!!

The second part of this discussion is that the setting of your interest rate is made in a market environment. This means you can negotiate lower rates if you can show the bank you are either (1) managing your business risk better than what they think you are or (2) you have put your financial business out for other banks to quote, which increases the competition for your business financial requirements and you may get better interest rate deals offered to you. In this case, it is highly likely your current bank will meet any interest rate quotes from competitors, so you should be better off either way.

Graph 1: Rural Banking Interest Rates are set on the RBA Cash Rate

Recent users of P2PAgri have reported that they have achieved drops in their interest rates of 1 – 1.5% after discussion with their bank. On a $1m loan, this means an annual savings in annual interest payments of $10,000 – $15,000. In some cases, it has been reported to be as high as a $40,000 annual saving on this size of borrowing, so higher interest rate savings may be achievable.

So there is room for negotiating your rural banking rates.

Has anything really changed since the Royal Commission?

The frustrating observation is that even though the Banking Royal Commission highlighted significant banking malpractice and gave significant guidelines for the Federal Government to implement, little has changed. The Federal Government argue that in the last 6 months with the election, they have only had a limited number of parliamentary sitting days in which to implement changes. The question remains, though, of whether they have the political appetite to push for the changes needed!

One change that has occurred is that banks are placing more emphasis on lending governance, which means more information needs to be provided with any new rural banking and the process now takes longer. So if you are looking to change your rural banking, you will need to (1) do more paperwork and (2) allow for more time to get your financial proposal accepted.

The irony is that even though the bad banking habits were shown in the Banking Royal Commission, it appears yet again the banks’ customers pay the price!!

The rural economic planets have lined up for many Australian farmers

I just wanted to point out that a number of significant shifts have occurred to make farm financial performance look very good at the moment for many Australian farmers. This is a summary of a number of talks I have given to Grains Research Development Corporation (GRDC) workshops in the last month. While large areas of Qld and NSW are still in drought, other parts of rural Australia will be benefiting from:

So the advice is similar to hay making – ‘Make hay while the sun shines’!

As usual, be careful with your business planning and spend wisely. If you find yourself with significant farm profits, look to decrease debt or deposit in Farm Business Deposits (FMD), as these good times will change! Put away savings in the good times to be better prepared for the poor times when rural banking can be challenging.

If you feel a need to further improve your farm business financial knowledge and control, we would be happy to help you at P2PAgri. Our software has been getting great user reviews and we are currently providing training and support freely within the licence fees of the P2PAgri software. Contact us today for a no obligation discussion or visit our www.P2PAgri.com.au website and look at the free DEMO or sign up for a free essentials account.

If you are looking for an P2PAgri Accredited Adviser, check out our advisers on our website.

Mike Krause is one of Australia’s leading Farm Business Management consultants with significant experience in providing farm business management support, training and consulting to Australia’s agricultural and agri-business industries.

This experience forms the basis of significant developments:

‘Farming the Business’ manual Mike produced for the GRDC.

‘Plan to Profit’, the successful desktop software developed and sold by Mike over 12 years.

P2PAgri, our new online platform for farmers and advisers. Check it out on www.p2pagri.com.au.

Leave A Comment

You must be logged in to post a comment.