Now is the time to sharpen your farm business tools for securing farm finance as credit may be more difficult to access as a result of the Banking Royal Commission.

With the dust beginning to settle on the Banking Royal Commission report, now is the time for farm businesses to be proactive! Just like seasons have their cycles, the finance industry has its cycles and we could be heading into a ‘finance drought’. In other words, credit may be harder to get!

To ensure credit is always available to your farm business, we need to understand what banks want, and then provide that information to them professionally. Action you take can have a significant impact on your business securing farm finance.

Banks: Enemy or Partner?

During the Banking Royal Commission, it has at times been a challenge not to see the banks as the enemy, with the farmer often cast in the role of David against Goliath…and not always winning! There has rightly been condemnation of many of the practices exposed through the Royal Commission. Among others, the plight of the agricultural and small business sectors was recognised.

But farm businesses need banks. They provide the financial fuel tank for our farm business engine! The better we work with them, the better we will be at securing farm finance and improving our financial efficiency.

So how do you turn your bank into an effective business partner? One who is on your side, rather than an ‘enemy’ of business?

How do Banks Cover their Risk of Lending?

When assessing any loan application, banks will look to cover the risk of lending to you from both a business and a personal perspective:

| Area Assessed | What evidence can you provide to the bank? |

|---|---|

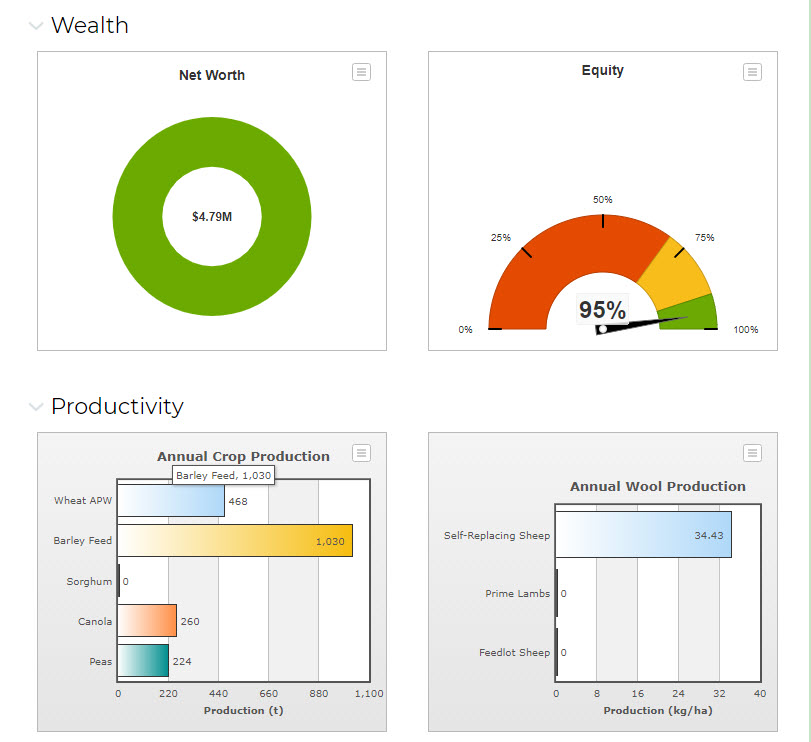

| 1. Does the business have the ongoing capacity to repay the loan in the short term? | A projected Cash Flow from your farm business management of the coming season. |

| 2. Does the business have ongoing capacity to repay the loan in the long-term? | Run your projected Profit and Loss numbers for an average, poor and good season, to assess the business risk profile and real ability to repay loans. Also, project the Profit and Loss for the next 5 years to see what your business finance capacity can achieve. |

| 3. If your business goes ‘belly-up’, will the bank get their money back? | A Balance Sheet of your business that shows your liability and equity position. The higher the equity, the lower the risk to you and the bank. |

| 4. Can they rely on you as a borrower? | This is a more subjective measure but is likely an assessment of your character: your reliability, honesty and integrity as demonstrated in previous dealings with the bank. Also of considerable importance here is your management expertise, assessed by how professionally you present your business to the bank and how well this is communicated. |

Strategies to Help in Securing Farm Finance for your Business

During times of ‘finance drought’ such as we may be approaching, banks are even more risk averse in lending finance to any sector, and agriculture will be no different.

So what key strategies can you employ to make your chance of securing farm finance more successful?

Mike Krause is one of Australia’s leading Farm Business Management consultants with significant experience in providing farm business management support, training and consulting to Australia’s agricultural and agri-business industries.

This experience forms the basis of significant developments:

‘Farming the Business’ manual Mike produced for the GRDC.

‘Plan to Profit’, the successful desktop software developed and sold by Mike over 12 years.

P2PAgri, our new online platform for farmers and advisers. Check it out on www.p2pagri.com.au.

Leave A Comment

You must be logged in to post a comment.