Interest Rates and Your Farm Business

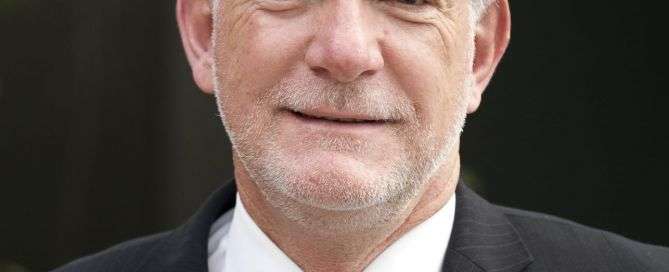

Darryl Gobbet is currently a Visiting Fellow at the SA Centre for Economic Studies at the University of Adelaide. Darryl is an eminent economist and has had many roles in his successful business career. Darryl and Mike’s path first crossed in the late 1980’s at The State Bank, the predecessor the BankSA. Notably in those times interest rates reached the giddy heights of 22%. Darryl shares his thoughts on current interest rates and where he thinks they are heading, and the impact of this on the farm business and rural land values. [...]