The completion of the annual business tax return comes as a major relief to us all, often with a heartfelt, ‘Thank goodness I don’t have to do that again for another year!’

However, the discipline of completing the annual tax return does have benefits apart from hopefully saving you tax:

- The process makes you assess another year’s income and expenses and can, with some editing, measure your business’ financial performance.

- It becomes even more valuable if you look at this edited income and expense trends over a number of years.

- In fact, as a tax return is the only legal document on financial performance, the banks place a strong reliance on this information to determine if they should continue to lend to the farm business.

Financial literacy is a major challenge for farming families, rural communities and the agricultural industry at large. If we are going to change and improve our farming business performance, a good place to start is to educate ourselves to really see what a tax return is telling us about the financial performance of the farm business.

How do you use your tax return for management decisions in your business?

When using your tax return for management decisions, keep the following in mind:

1. A tax compliant or management accountant?

Most accountants who assist farmers with tax returns are likely to be tax compliant accountants. That is, their focus when doing the farm business accounts is primarily to assess the tax liability of the business. Many may not be trained nor motivated to do any more than this compliance.

Implications?

With just a bit more work, your tax return information can be further developed to help answer questions you may have about your business re viability, efficiency or business improvement.

Check out if your accountant can also help you answer these business management questions.

2.The financial year vs management year?

The taxation year in Australia is based on a July to June time period, which cause challenges for a business whose production season runs across different financial years. For most cropping farms, the financial year means assessing the income of one season against the costs of the next season.

Implications?

When looking at financial performance, bear in mind that this doesn’t assess a complete season. So, it’s best to look at the trends for at least 3 years to smooth out the issue of looking at annual results that don’t capture a complete season’s results.

3.Profit minimisation?

To pay minimum tax, the aim is to minimise the business profits. So, the tax accountant is looking at legal means to minimise the business profits.

Implications?

To see how the business is really performing, develop a management Profit & Loss. To do this, the tax return needs to be adjusted to allow for the money transfer that occurs between the various business entities and family drawings need to be added.

4.When many entities make up the business?

Due to complex tax laws in Australia, tax accountants will often advise businesses to set up a system of trusts, partnerships and sometimes companies. Money is transferred between these entities to help minimize tax liability.

Implications?

The key is that only one of these legal entities will manage the business of the farm. Use this entity when developing financial performance reports on your farm business, such as measures of Efficiency and Wealth.

5.Cash vs accrual accounting?

Tax can be assessed on either a cash or accrual basis. Cash is simple to understand as tax will only be paid on income and expenses experienced in that financial year. Accrual, on the other hand, means you can be taxed on income that is owed the business, regardless of when it is received. Also, tax is assessed on owed expenses, rather than when they are paid.

Implications?

When assessing a Management Profit & Loss and being able to compare it between years, it is best to use the accrual method. This will mean the results will not be influenced by cash flow issues, which can change from year to year and influence the results.

6.Tax liability information vs financial performance information?

Your tax return is the only financial document you are legally required to do each year, and must be completed in accordance with ATO rules. As a result, the reports available in your tax return, such as a Profit & Loss and a Balance Sheet, reflect the ATO rules, and do not include some financial information that would make them suitable for use in business management decisions.

Implications?

With the addition of some extra financial information from your business, it is possible to adjust the information in the tax return to develop business reports that provide a more accurate picture of your business management Profit and Loss, and Balance Sheet. This will also provide some financial ratios that indicate the level of financial performance.

Key farm business performance measures

What are some of the key business management questions you could be asking of your business financial records? The following 3 measures of business performance can help start your thinking:

- Liquidity

This is the measure of whether there is enough cash coming into the business to be able to pay the expenses and financial costs on time. This helps answer questions about your business viability. Your tax return will not have any indication of cash flow. Most farmers would use an operational cash flow, even if it is on paper or an Excel spreadsheet.

The true value in using this performance measure is in comparing what actually happened against your planned cash flow. For example, keeping a history of these results over a number of years can be a persuasive tool to show a banker when applying for a loan, as demonstrating whether you are able to manage the flows of capital within your business and should be a reliable customer for a further loan.

- Efficiency

Are the assets in the business of land, machinery, livestock and water being used as efficiently as possible, and providing the best financial return? How does this compare with returns in other industries or investments?

If we are not measuring this performance of the business, it will be very difficult to identify strategies to improve business efficiency and profitability.

- Wealth

Is the business building the wealth needed to assist the business manage risks and family business succession?

Interestingly, by itself, the tax return addresses none of these performance measures! However, with some adjustments the last two can be measured. So, are you making the most of your tax return?

Steps to learn more

If you are interested in learning more about turning your tax return into useful business management information for your farm business, the following steps are suggested:

- You could:

- Check with your accountant whether they can help you do this.

- Alternatively, you can explore developing these key business skills and knowledge yourself.

- Consider the questions you may have about your business in the areas of Liquidity, Efficiency and Wealth. An excellent resource to help you investigate these performance measures and how they can be used to support your business is the GRDC’s ‘Farming the Business’ manual. Details of how to get this in either a hardback or eBook format will be available on the GRDC website.

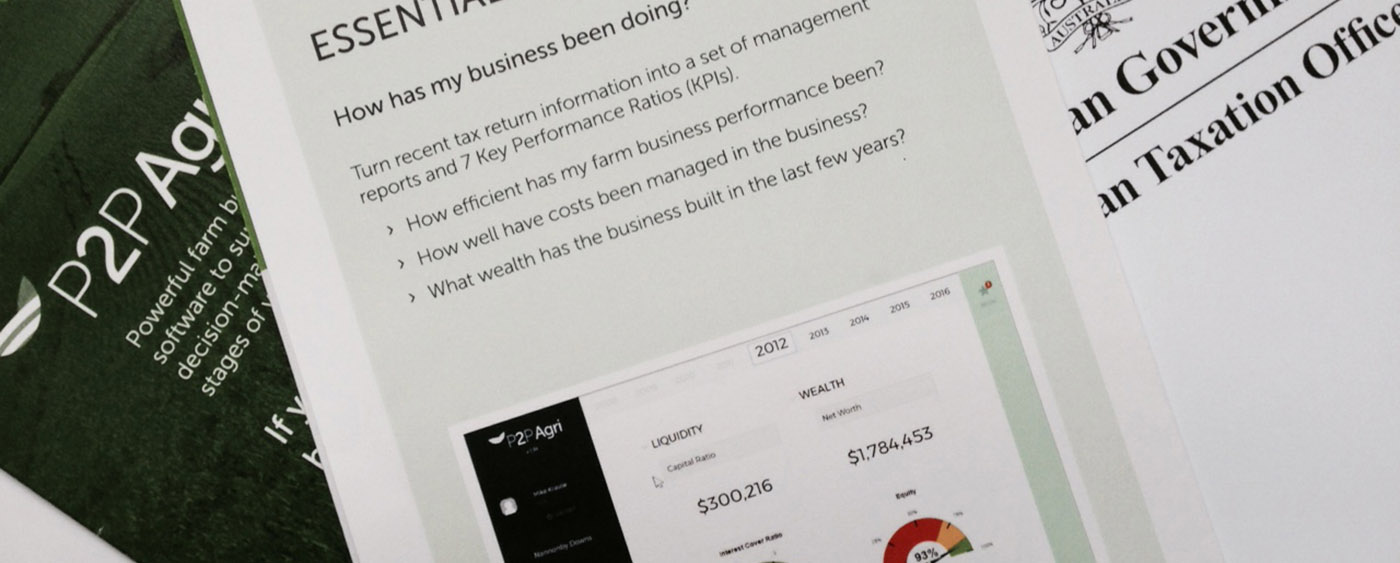

- You could use ESSENTIALS on P2PAgri platform. ESSENTIALS has an easy assessment method to convert your tax return information to key farm business management reports: Profit & Loss, a Balance Sheet and other key performance ratios. Short videos embedded in ESSENTIALS will guide you through this process.

Using the farm business performance measures of liquidity, efficiency and wealth will help you clarify the questions, expectations and goals you have for your business. Make your tax return work for you, and not just the ATO!

Leave A Comment

You must be logged in to post a comment.