How will P2PAgri and Xero integration work together to help you?

1. In ESSENTIALS: Quickly and easily develop past business trends and performance ratios

Traditionally, your tax return:

- Tells the ATO what tax you need to pay,

- Gives your Banker an understanding of your business performance.

Using the ESSENTIALS level of P2PAgri:

- The ESSENTIALS level of P2PAgri converts your tax information into valuable management information to help inform your business decisions and directions! It helps your tax return work for you!

Now, with XERO and P2PAgri integration:

- Save time with data entry! No need to enter your tax return data into ESSENTIALS yourself – just import from Xero!

- Makes it even easier to develop your current:

- Multiple-year business trends

- Vital financial ratios from your business

- Efficiency performance and wealth development measures of your business

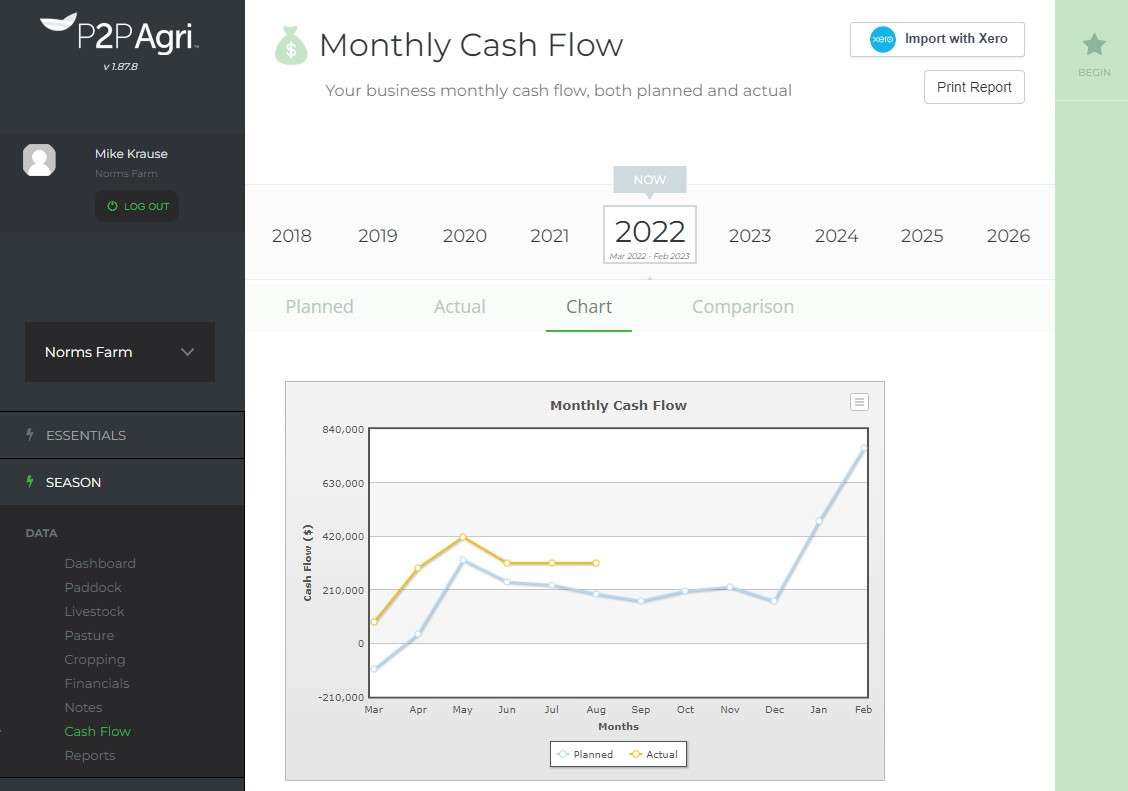

2. In SEASON: Plan and easily track your actual monthly cash flow budget.

The monthly cash flow:

- The banker asks for this at the beginning of the season so they can check when and how much of your overdraft is needed during the season.

- Industry tells us the best way to use monthly cash flow is to compare the ‘plan’ with the ‘actual’ through the season. But as this was so time-consuming to do manually, few farmers did this!

Using the SEASON level of P2PAgri:

- In SEASON, you can both plan the monthly cash flow with confidence and compare this with the actual as the season unfolds.

Now, with Xero and P2PAgri integration:

- Data from Xero is automated into P2PAgri, saving time in monthly cash flow monitoring.

This is a game-changer if you want to do your best every season. - You can easily compare each income and expense category to see where the ‘planned’ and ‘actual’ differ. Get greater insight into the dynamics of your monthly cash flow for more informed decisions within a season. Make the most of your tactical decision-making in response to the season you are actually experiencing.

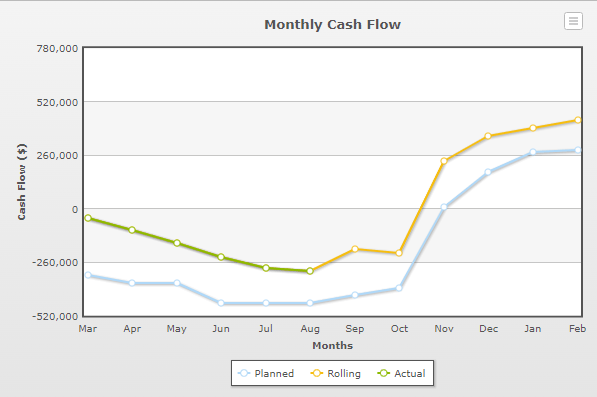

3. In SEASON: ‘Rolling Cash Flow’ is unique and allows you to react within a season .

A traditional monthly cash flow:

- The big advantage of actively managing your monthly cash flow is you can respond better to opportunities that occur within a season.

- In the chart to the left, the blue line shows the plan for the year ahead. The green line indicates the actual cash flow up until August. The yellow line indicates the revised, or Rolling Cash Flow, for the remainder of the year. This allows you to monitor and alter your plan to better match the season.

Using the SEASON ‘Rolling Cash Flow’ of P2PAgri:

- The ‘Rolling Cash Flow’ allows you to create your planned cash flow and update actuals as they occur. This gives you an easy way to review and change the remaining months of of your cash flow projections for rest of the year.

- Assess what can be tightened if the season starts poorly, or look at the best opportunities if the season starts well.

- This helps you to keep your finger on the cash flow pulse, minimising the effect of a poor season and maximising the opportunities of a good season.

Now, with Xero and P2PAgri integration:

- As the season unfolds, your income and expenditure can be automatically imported from Xero into P2PAgri at any time, easily updating your ‘Actual’ cash flow and saving you time. In the ‘Rolling Cash Flow’, you can continue to alter your ‘within season’ income and expenditure, remaining more in control of your business.

- This is a ‘break through’ for active cash flow management:

- Import your Xero data to easily compare ‘Planned’ vs ‘Actual’

- Continually review and edit your planned cash flow in ‘Rolling Cash Flow’ to help meet your targets at the end of the year.